Empowering insurance policyholders in managing policies and resolving grievances

Empowering insurance policyholders in managing policies and resolving grievances

Our Services

We help to ensure that people have a voice and a means of seeking redress when they feel wronged or mistreated. Take a look at the services that we deal in:

Policy Clarity

Eligibility Check

Bill Review

Cashless Help

Claims Support

Coverage Guidance

Our Services

We help to ensure that people have a voice and a means of seeking redress when they feel wronged or mistreated. Take a look at the services that we deal in:

Policy Clarity

Eligibility Check

Bill Review

Cashless Help

Claims Support

Coverage Guidance

Claim Rejection

Insurance claim rejection is a heartbreaking experience. But you don't have to fight this...

Delay in Claim Process

Insurance companies can be slow and sometimes unresponsive when processing claims. We at InSa value the importance of your time. Weassist you in ensuring that you get your claim amount settled, as we know it can be an annoying experience for the policyholder.

Health ClaimReimbursement

An insurance claim can take time to file, and there's a possibility that it will...

Know Your Policy

Know Your Policy aims to assist customers in identifying any mistakes or errors, such as incorrect declaration of health conditions, lifestyle habits, contact information, or nominee details, within life and health insurance policy documents.

Claim Rejection

Insurance claim rejection is a heartbreaking experience. But you don't have to fight this...

Delay in Claim Process

Insurance companies can be slow and sometimes unresponsive when processing claims. We at InSa value the importance of your time. Weassist you in ensuring that you get your claim amount settled, as we know it can be an annoying experience for the policyholder.

Health ClaimReimbursement

An insurance claim can take time to file, and there's a possibility that it will...

Know Your Policy

Know Your Policy aims to assist customers in identifying any mistakes or errors, such as incorrect declaration of health conditions, lifestyle habits, contact information, or nominee details, within life and health insurance policy documents.

Why Insurance Samadhan?

We take pride in our process, and we want to share it with you. Discover the steps we take to ensure that our service meets the highest quality standards.

Why Insurance Samadhan?

We take pride in our process, and we want to share it with you. Discover the steps we take to ensure that our service meets the highest quality standards.

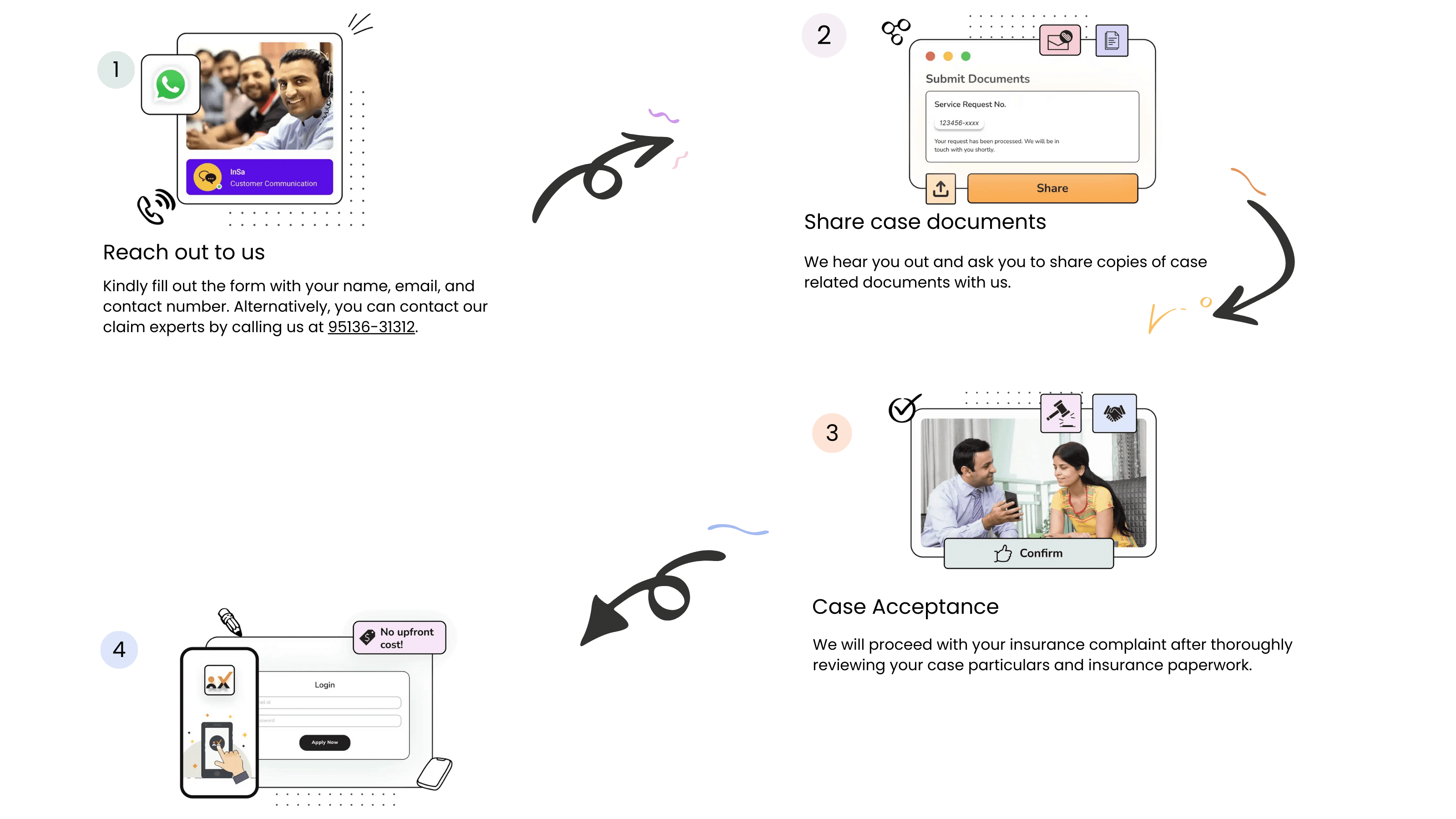

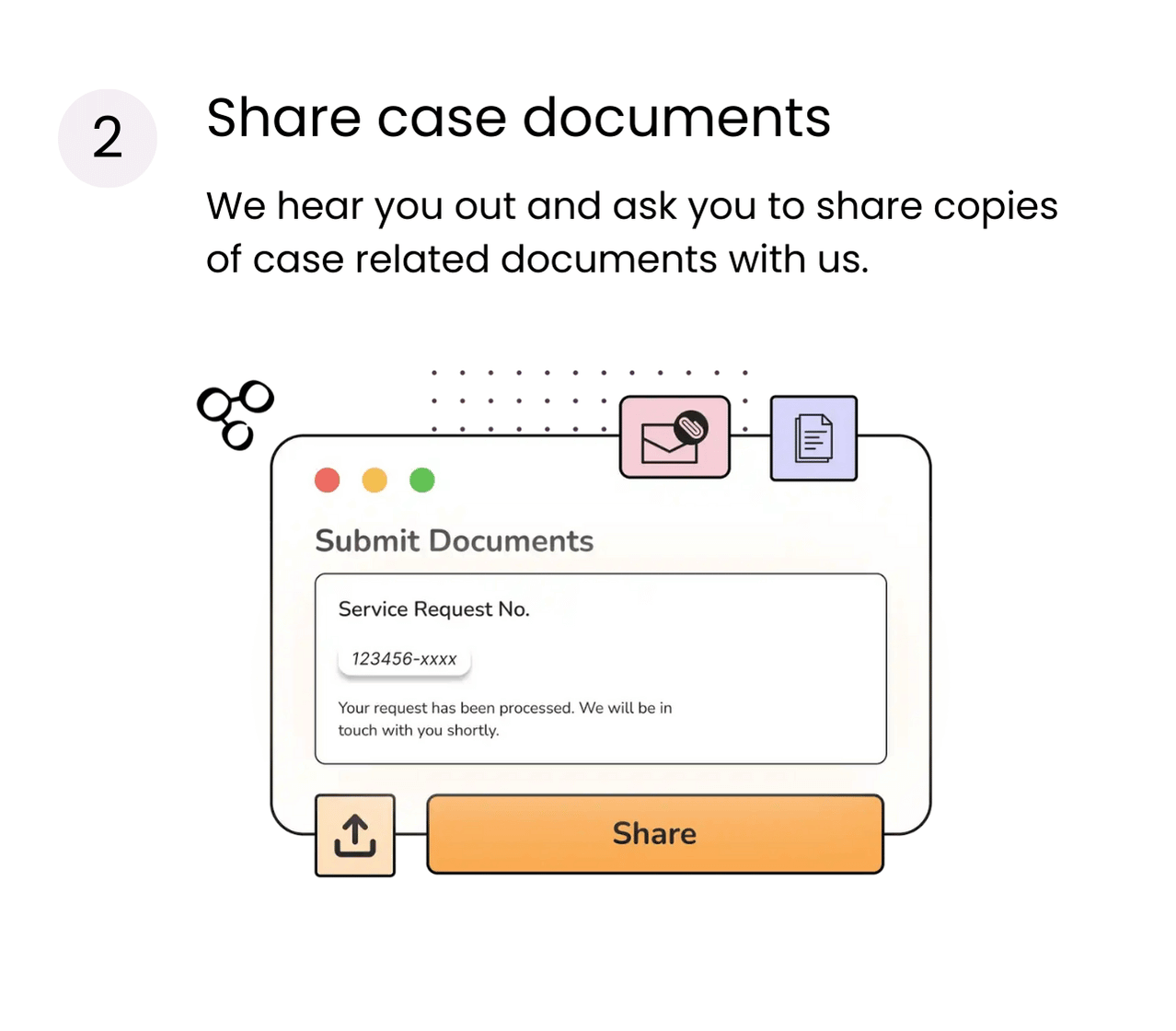

Our Hassle-Free Process

Team of Industry Experts

Insurance Samadhan has a highly efficient team of experienced insurance consultants who can always assist you. Our team is equipped to address any kind of issue you may encounter with your insurance policy.

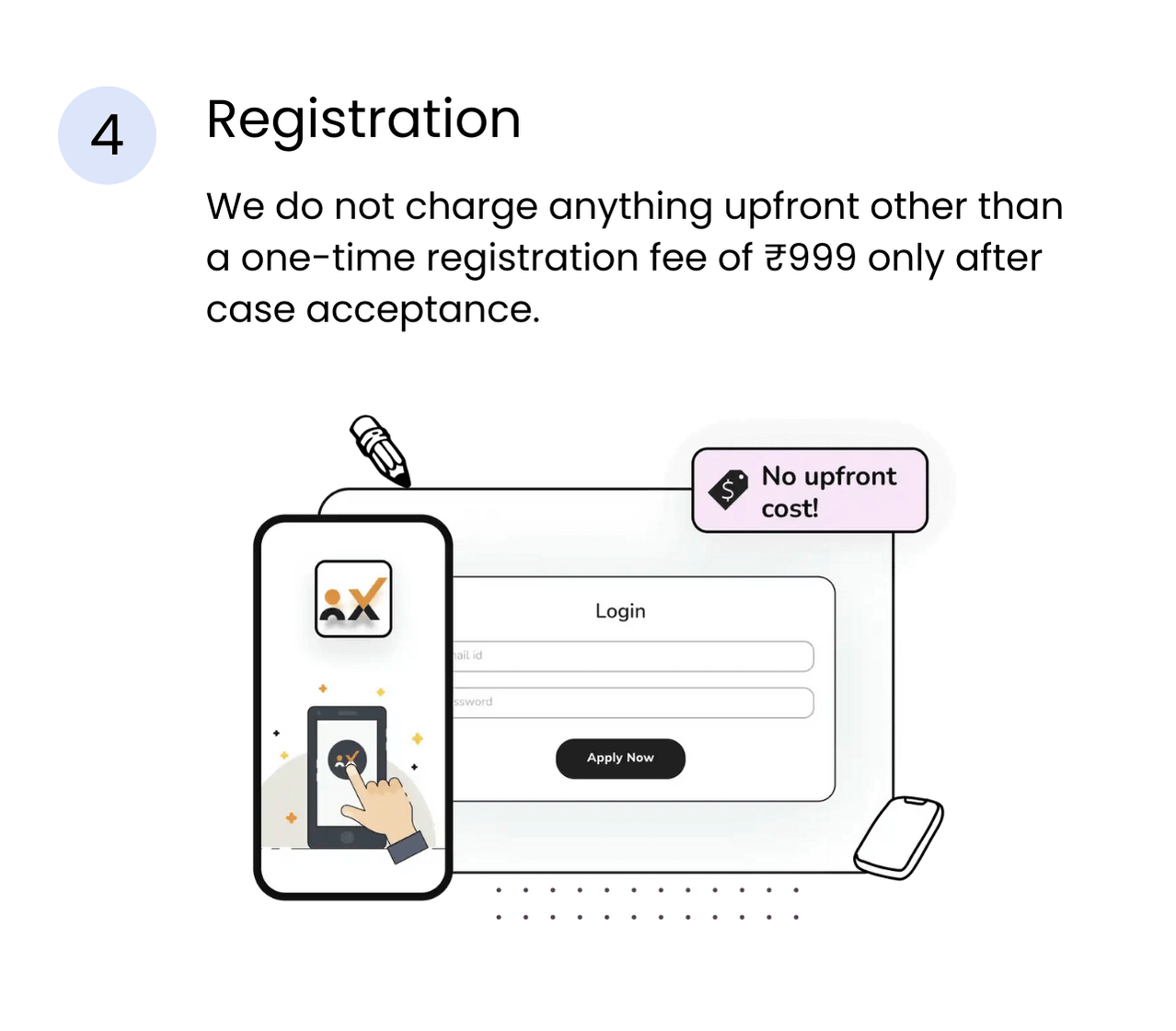

No Upfront Charges

We understand that customer satisfaction is paramount and we are committed to providing a hassle-free experience for all our clients. That's why we do not charge any success fee until the case is resolved.

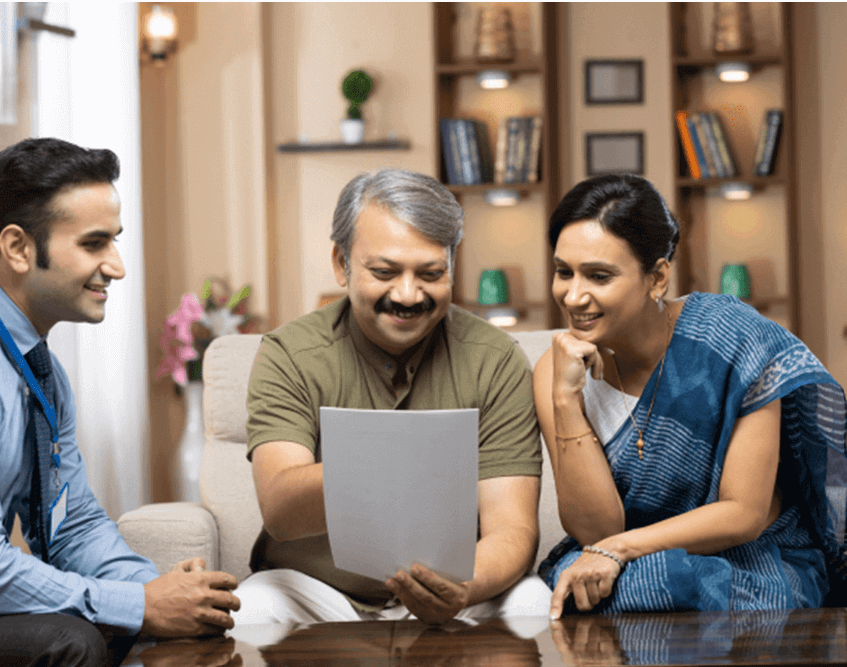

Customer-First Approach

We recognise the importance of our customers and are committed to providing them with the highest level of service. Our goal is to create a positive impact in the lives of our customers by delivering exceptional value through our services.

Are you facing similar issues while claiming your insurance?

Let's connect! Reach out to us today and get your claim amount.

FAQs

What are some common examples of insurance mis-selling?

You can be sold an insurance policy wrongfully in many ways. Let us take a look at some of them:

Promising interest-free loan on a mortgage or insurance plan.

The promise of free health insurance.

Insurance sold as a Fixed deposit in a bank.

Why do insurance companies reject claims?

There are many reasons why your insurance claim can get rejected, such as a delay in Health Claim Reimbursement, insurance policy exclusions, PED not disclosed, etc. It is important to avoid any such insurance claim rejection scenarios.

Can an insurance claim be delayed due to pre-existing conditions?

A claim can be delayed due to pre-existing conditions, especially if the insurance company needs to review the policyholder's medical history or obtain additional information from the healthcare provider.

Can a short-settled claim be re-submitted for payment?

Yes, a short-settled claim may be re-submitted for payment.

How do I check for errors and Inconsistencies in my/family member's policy document?

Access the 'Know Your Policy' feature on our mobile application "Polifyx" to upload your complete policy document and identify any errors or inconsistencies that could result in claim rejections or delays in the future.

How do we handle your case?

We help you represent your case with the Insurance Company, Insurance Ombudsman (Bima Lokpal), and consumer court depending on the case.

How can I track the status of my insurance complaint?

Once your case is accepted and registered, you can get real-time case updates on Polifyx App.

Is there any fee to register with us?

A one-time registration fee of INR 999, including GST, is applicable for all life, health, and general policies for you and your family members after case acceptance.

What is a success fee?

Once we successfully resolve your insurance complaint, we charge a success fee of 15% of the amount received (plus GST).

How long will it take to resolve my insurance-related problem?

Any insurance-related matter problem totally depends on the case. So, it is advisable to be patient.

What is the pre and post hospitalization claim?

Generally expenses 30 days before the hospitalization and 60-90 days post discharge from the hospital are covered in the medical policy. We help apply your reimbursement at a nominal cost of INR 799 taking away the hassles of filling and submitting the claim forms.

Does smoking affect insurance plans?

It is essential to disclose your smoking or alcohol consumption habits while purchasing insurance as it would be unethical to withhold this information and may result in claim rejection.

Is there a waiting period before filing a claim under a health insurance policy?

Typically, there's a waiting period of 30 days from the insurance policy's start date.

What should I do if I am admitted to a hospital that is not within my network?

If admitted to a hospital outside your network, you would typically need to pay the bills upfront and seek reimbursement from your insurance company afterward.

What is insurance mis-selling policy?

Mis-selling of insurance policies refers to when an agent or intermediary purposefully sells a client an insurance policy that is not what it is, is not fully explained to them, or is offered to them outside their intended target market.

How can an insurance policy be mis-sold?

Mis-selling of insurance policies refers to when an agent or intermediary purposefully sells a client an insurance policy that is not what it is, is not fully explained to them, or is offered to them outside their intended target market.

We redefine the cancer care experience by offering expert advocacy, simplifying complex treatment decisions, and guiding patients to transparent, affordable support at every step.

Contact Us

- 49/ 50L, EA Chambers Tower II, Royapettah, Chennai - 14, India.

- +91 7305088492

- support@myonko.com